What is a R&D Tax Credit?

6/24/24 – Steven Jefferies

In 1981 Congress passed a law to launch U.S. businesses forward into global competition and innovation. Today, the Research & Development tax credit is stronger than ever.

The R&D tax credit is a strategic dollar-for-dollar reduction in a U.S. taxpayer’s tax bill that is often available for business that operate in states that recognize the tax credit. The amount of the R&D tax credit is based on the taxpayer’s annual qualified R&D spend. You can generate a R&D tax incurring wage, supply, and contractor expenses each year. The R&D credit allows for you to recoup roughly 10% of your annual R&D spend. These research and development tax credits can be used on your prior 3 years of tax returns, and R&D credit carry forwards can be used up to 20 years into the future as well. They can be very beneficial for businesses that have R&D activities by substantially helping to offset the costs.

Endeavor Advisors possesses the industry knowledge, accounting experience, and legal expertise necessary to provide you with a user-friendly solution for R&D credit analysis.

How Endeavor can File Your Research and Development Tax Credit

Endeavor Advisors R&D tax credit firm was founded by partners that have extensive experience in the research and development space. We are a turnkey R&D specialist – we walk you through from an initial qualification call & credit estimate, all the way through to quantifying your R&D credit, providing pro-forma forms for you federal and state filings, and ultimately complete your R&D study with a comprehensive Final Report documenting each step of the process.

Often times, business owners approach us for guidance on filing corporate R&D tax credits or Employee Retention Credits (ERC) that they were previously claiming in house. Nine times out of ten, Endeavor R&D Tax Credit Advisors finds that taxpayers are under-claiming credits. In addition, their credits are often under-substantiated and documented. For these reasons, it is imperative to consult with an R&D expert to ensure that your R&D study process is held to an appropriate standard of excellence.

Your Industry is Earning Huge Tax R&D Tax Credits...

Is your business?

Which states qualify for R&D tax credits?

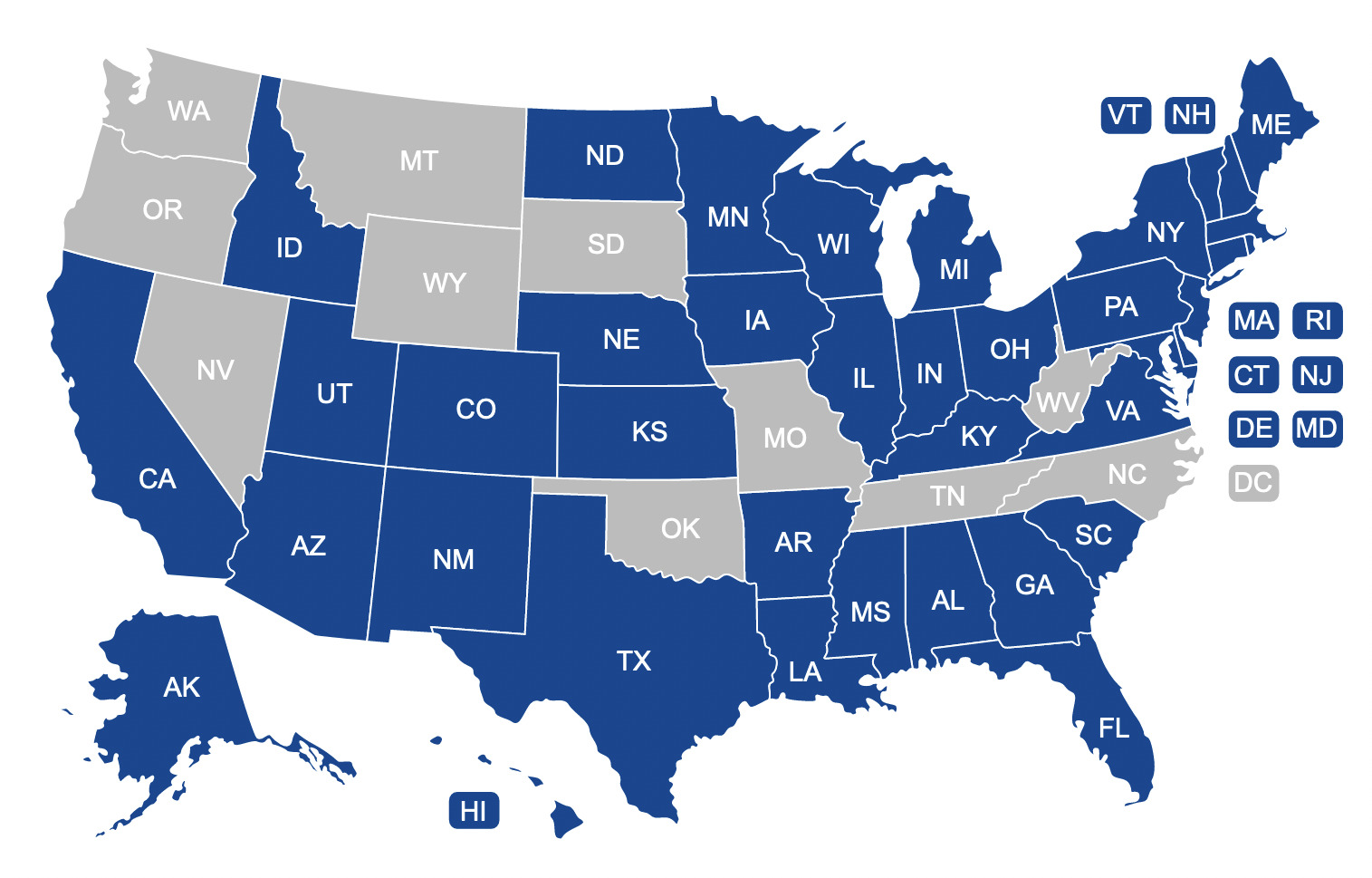

Currently 38 states qualify for R&D tax credits while 12 states do not. Check to see if your state qualifies.

Testimonials

Imtiaz

We have been working with Endeavor Advisors for a few years now, and we can vouch for their ability to execute on complex R&D studies. They consistently find more credits than our clients were finding on their own. We are satisfied with their methodology and responsiveness, so we can rest assured that our clients are in good hands with Endeavor.

Kerri

We have worked with Endeavor Advisors on several mutual clients. We find their R&D services to be timely, well-executed, and easy to integrate into our business. Most importantly, we have received consistently positive feedback from our mutual clients!

Vimal

We began working with Endeavor Advisors on the advice of our CPA. After having claimed the R&D credit previously, Endeavor was able to find us significantly more credit, and document our R&D study process with a thorough final report. After reviewing the quality of their work product, we have decided to use Endeavor each year for our R&D credit needs. They are respectful of our time, professional, and flexible.

Lukas

Steven at Endeavor Advisors helped me with a one-off legal issue, and I am here to attest to his professionalism and attention to detail. Even when he was operating outside of his usual tax specialty, he showed up with a poise and presence that helped us achieve a great result in our case.

This page was last updated by Steven Jefferies

Would you like to speak to one of our R&D tax credit advisors over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer or find more information here: https://randdtaxcredit.co/